Last year I had just finished a seminar to thirty pre-retirees on retirement strategies as I was approached by one of the attendees and her husband. For purposes of this article, I will call her Sarah and him John. Sarah and John were both 63 years of age and she started the conversation with “I really need your advice on something“. It was clear she was profoundly serious about what was on her mind. Sarah immediately proceeded in the conversation with telling me that they had 250 acres of farmland that had been in her family for generations. They also had a couple of small IRAs. The total assets amounted to around $1.5 million in TOTAL ASSETS. As you know, this is not a real common conversation to have at the front of the seminar room immediately after the seminar, but she laid it all out for me. She almost had a sense of urgency. Sarah then transitioned into how her mother had just passed away after being in the nursing home for three years. I thought I knew exactly where this conversation was going whereas she was going to ask about the various types of long-term care insurance that exist. Although that was a part of our later conversations, that was not where she took the conversation next. She then said “so here is what I need guidance on. How do we protect our retirement assets and most importantly the farmland that has been in our family for generations should either of us go into the nursing home”? What she was getting at was not just LTC Insurance, but also Medicaid. Naturally, we took this conversation off-line to a series of appointments the following weeks.

My point above demonstrates a few points:

- Number one is, that there is nothing as emotionally charged in the financial lives of consumers as a “long-term care” as they are called. Every time somebody explains the financial and emotional experience they had with a family member’s long-term-care process; it is heartbreaking. And, as many know, it is a 70% probability for one over age 65. Thus, the need for Long-Term-Care Insurance.

- The second issue is Medicaid! How Medicaid works is something that every financial professional should be somewhat familiar with and be able to help you with. Unfortunately, that is not the case.

- The preconceived notion with Medicaid Planning may be that it only applies to “poor people“ on their way to the nursing homes. That is not the case, as we saw with the example of Sarah and John.

Now of course my conversation with Sarah and John included LTC Insurance as Medicaid is not a great alternative to having had a full-blown plan that includes LTC Insurance. However, this couple was in crisis mode as they both were uninsurable – she had already been treated for cognitive decline and he had serious heart issues. I bring this up because some folks will view Medicaid strategies as an alternative to a true LTC plan. It is not. It is a last resort strategy.

With that said, allow me to explain some basic concepts when it comes to Medicaid so at the very minimum, it allows you to be “dangerous“ with things to take into consideration. Please note that my commentary is merely meant to be a “plain English” description that gives you a basic understanding of the concepts. This is not all encompassing. So, if you are reading this article expecting me to discuss the fine technicals of all of this, you are reading the wrong article. Qualifying for Medicaid is one of the most complicated strategies that a we can employ and therefore this column seeks to distill it down. This is a specialized field that very few financial professionals understand fully. We at CG Financial Group can help however!!!

What is Medicaid?

My unofficial definition of Medicaid for purposes of this article is: A federal/state joint health insurance program for individuals that have assets (countable assets) and income below certain levels. This is different than Medicare in that Medicare does not have maximum asset and income thresholds to qualify. Furthermore, Medicare does not cover LTC beyond one hundred days. Medicaid does. Although there are many requirements and parameters that the federal government creates for Medicaid, there is some flexibility – and thus differences – among the individual states. The states create rules within the framework of the federal government.

What is the Process?

Once you enter the realm of Medicaid strategies, you are in “crisis planning mode.” Once a consumer is in a situation where Medicaid is the last resort, the process might look like the below.

This is the process of preserving assets in situations where those hard-earned assets would otherwise need to be liquidated in order to fund LTC expenses. For example, Sarah having to sell the farmland in order to pay for her husband’s LTC would be a catastrophe!!! Medicaid strategies revolve around helping Sarah and John become eligible for Medicaid without having to spend a significant amount of those assets before they are eligible.

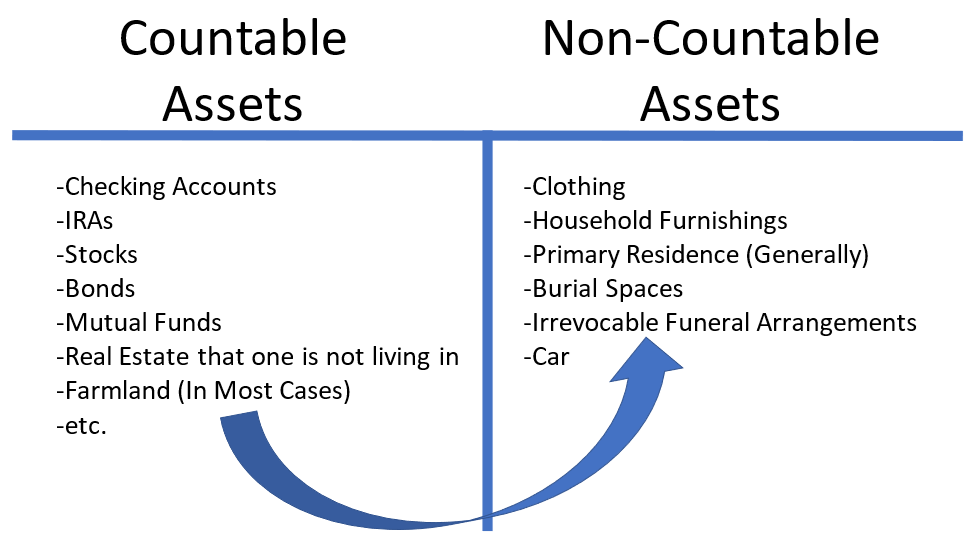

Sticking with the theme of extreme simplicity, the strategy is largely about moving the assets in the left column (below) to the right column, or completely off the grid (Irrevocable Trusts).

Clearly, we need to back up for a second and explain the relevance of the above T-Chart and what this means.

Let’s take Sarah as the example here. Let’s say that in 20 years her husband – John – goes to the Nursing Home. Naturally, we do not want them to liquidate the IRAs and/or the farmland in order to pay $100,000 per year (approximate National Median cost of private room in TODAY’S DOLLARS) for the nursing home. So, what will she do? She might seek the assistance of Medicaid and fill out the Medicaid application. On that Medicaid application they would ask for all of their assets as well as income sources, including social security.

Medicaid breaks the assets into two different sections. One section is “countable assets“ and the other section is “non-countable assets“. When I am explaining this to clients, I draw the exact T-Chart that you see above. In one column is the countable assets and the other column is the non-countable. The non-countable assets column is the good column. These are the assets where Medicaid has deemed them to be an asset that you should not have to liquidate to pay for your care. Unfortunately, this list is usually small relative to the other column. It is usually items like clothing, household furnishings, the residence, etc. These are assets that you should NOT have to “spend down” in order to be eligible for Medicaid. I should not have to sell the shirt off my back for Medicaid to kick in. Bad visual I know! Medicaid does not punish you for these assets when it comes to Medicaid eligibility.

Now, the Countable Assets – left column – are the ones they focus on. Countable assets would be Checking accounts, IRAs, stocks, bonds, real estate that one is not living in, farmland (in most cases), etc. If John has “Countable Assets” in today’s dollars over $2,000 (Iowa), he is not eligible for Medicaid. They have to “spend down” their assets in order to become eligible. Keep in mind that the spouse that is not in the nursing home is allowed $137,400 in assets. This is to prevent “spousal impoverishment.” So, what does that mean? It means without proper planning; they would have to spend down a large chunk of their $1.5 million in “Non-Countable Assets”. To be exact, they would have to spend down $1,360,600 in assets. That would leave John with his $2,000 and her with her $137,400. This is without discussing Medicaid’s income limitations on John ($2,523/month), which we will discuss in detail another time. In Sarah and John’s example, it would mean selling farmland and liquidating the IRA.

What strategies can be explored to avoid “Spend Down”?

There are several steps they can take (or should have already taken), but here are a few that one should look at:

- They could have gifted some of their assets to others as the years have gone by. Now, what if Sarah and John gift all of their otherwise “countable assets” to somebody else the day before they apply for Medicaid? Would this make them eligible for Medicaid? NOPE. The government has recognized this strategy and therefore has a 5-year “lookback” in most states. For veterans, the lookback can be 3-years. Therefore, in this example, there would be a period of time where Sarah and John would have to pay their own way. This is called a “penalty period.”

- Irrevocable Trusts: This is a great tool for Medicaid planning as it removes the assets from Sarah and John’s ownership. However, the lookback applies here as well. The farmland can be moved to an Irrevocable trust: Note: There are tradeoffs to moving property to an Irrevocable Trust, which is considered a separate entity from them! Make sure you work with an attorney to understand them. IRA money cannot be moved to an irrevocable trust. You must liquidate the IRA first.

- A Medicaid Compliant Immediate Annuity: This annuity would be for the retirement assets they have put aside. The notion here is, when you take an otherwise “Countable Asset” and turn it into an income stream (usually to the spouse outside of the Nursing Home), it becomes exempt from being a “countable asset.” Therefore, the 5-year lookback does not apply here. Of the three options I lay out here, this is the “last minute” option as it is not subject to the lookback. Note: Not all immediate annuities are “Medicaid Compliant.” Very few of them are. To be a “Medicaid Compliant Annuity,” there is a handful of requirements that must be met with the annuity. Therefore, the list of these annuities is very small but VERY EFFECTIVE.

In closing, it is important to note a couple of things:

Medicaid does seek to “recover” what John and Sarah will take from the Medicaid system once they both pass away!!! Many consumers are not aware of this. Although there are strategies (Irrevocable Trusts) that work as a shield against recovery, it is almost always best that consumers never get on Medicaid in the first place and instead have LTC Insurance to cover the cost. Without tapping into Medicaid, the estate does not have the government coming after them for “recovery.” The LTC products available today are fabulous and have innovated significantly. Plus, when you have the means to pay for LTC yourself, you have choices… One such choice would be to be cared for in your own home versus a nursing home!!!

Lastly, in this article we merely talked about the assets and the general idea around Medicaid Planning, that is greatly simplified. We did not even get into the maximum income for John to not have to pay the nursing home himself. We also did not speak about single retirees, Miller Trusts, Minimum Monthly Needs Allowance, Funeral Trusts, homes contiguous of farmland, Medicaid Divorces, Veterans, etc. So, if you have any questions or would like my feedback and guidance feel free to reach out. Phone: 515-986-3065

0 Comments