First off, if you like this whitepaper, feel free to register for our “Agent Portal” that has a couple hundred videos, whitepapers, and articles on all things annuities, life, and LTC. We are one of the fastest growing IMOs in the industry because of our quality education and sales ideas. Also note, if you are in IL, IA, or MN, we are conducting “Lunch and Learns” in November. Details HERE. Now, on to the whitepaper!!!

“How is it possible to get some of the upside in a market but none of the downside?” “No fees, just a cap?” “Seems too good to be true.” “Why are caps related to interest rates, versus the stock market?” “How do carriers do this?” “If the market goes up 15% and my indexed annuity is capped at 10%, you mean to tell me that the insurance company kept a whopping 5% of my growth???”

The above are just a few of the questions that you – the financial professional – will get if you do indexed annuity or indexed life business for any period of time. And for many financial professionals, this may be a “deer in the headlights” moment. I want to help you avoid that. Thus, the purpose of this whitepaper!!!

To get instant access to this unique whitepaper, give us your email address below to be added to our email list.

After spending 25-years in the indexed annuity and indexed universal life insurance space, I know that many financial professionals experience a lot of confusion around these topics. So, today we extinguish that ambiguity so that you can answer almost any question that comes to you in regards to “indexing”. As I like to say, if you know how the watch is built then telling somebody what time it is should be fairly simple.

As the owner of this IMO – CG Financial Group – I always commit to bringing you unique content that you find valuable, whether you are an insurance agent, registered rep, IAR, RIA, etc. We specialize in three product areas – Annuities, Life, and Long-Term Care – and we know how these watches are built!!! As I write for various trade publications monthly I always try to leverage my sales and technical background in order to bring you the product and practice management content that is outside of the typical “product” regurgitating that you see everyday in your inboxes. This article is no exception.

This article is a little bit on the actuarial side, so get out your financial calculators, spectacles, and your pocket protectors because we are going to have some fun with this article. In this article we are going to create a product. We are going to “build the watch.” Of course, I am being somewhat facetious because there’s much more that goes into “creating a product” then just the numbers and carrier investment strategies that I discuss below. However, by going much deeper than what this article does, we are just participation in mental gymnastics that will never be applied in a client meeting. The below information is kept “applicable” and “practical”, but yet unique to what you have previously seen.

Agenda:

- Set the stage with an example of a product we are going to build. What is the “Chassis” of our product?

- Determine how much we, the insurance company, can get in yield when we invest that client’s money.

- Based off our IRR requirements from the shareholders, how much of a “spread” do we shave off the top of the yield that we are getting in bullet point number one above.

- We then take what is left of the difference of number one and number two above and that determines our call option budget.

- We are “static hedging” this product and not utilizing “dynamic hedging”. Here we will buy and sell call options based off today’s (6/27/2023) call option pricing. Based off the pricing of call options, you and I will be able to identify what Cap Rate a person can get in today’s environment. Sounds pretty cool huh?

#1: What is the Product “Chassis”

Although this article can apply to Indexed Annuities and also Indexed Universal Life, let’s use an annuity for our example, while keeping in mind that the math between indexed annuities and IUL is similar.

Here is the product we – the insurance company – are going to create: This will be a 10-year indexed annuity that utilizes an annual reset S&P 500 strategy. This strategy has a “cap rate” that will determine the maximum amount of growth that the client can get in one year. What rate the cap will be set at will be determined based off today’s interest rates and options costs. This product will have a 7% commission to the agent. Furthermore, we – the carrier – have shareholders that require a “return” on the company’s capital to the tune of 8%. (more on this later)

#2: How much Yield Do We Get?

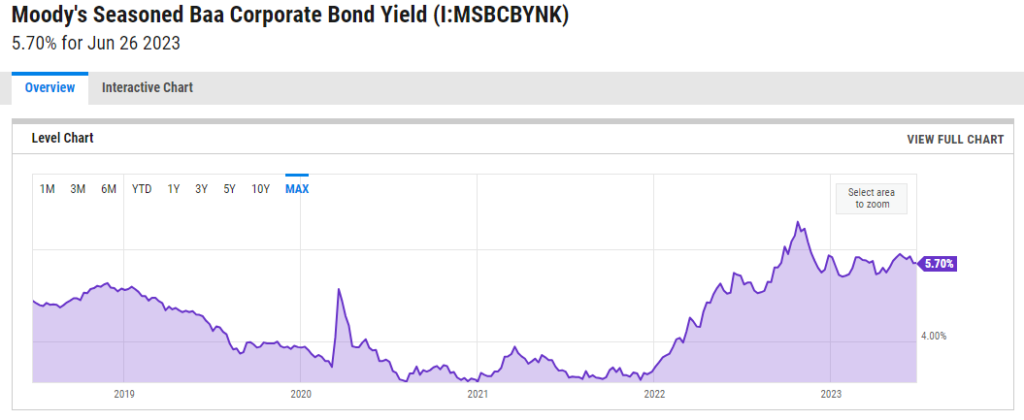

First off, when a carrier takes a client’s $100k (example), that carrier will invest almost all of that money in the bond market. Although a lot of folks use the 10-year treasury as “the benchmark” for the yield rate, a better benchmark is the Moody’s Baa bond yield. This is because carriers generally invest more in corporate bonds than they do in Treasury Bonds. Why? Because Corporate Bonds provide a higher yield. Corporate bonds are riskier than the US government. Furthermore, many carriers don’t invest a large portion of their portfolios in the highest of investment grade bonds (Aaa) that they can. This is because the lower down the quality “ladder” you go, the higher the yield is that the carrier can get. But yet carriers still want to keep most of their portfolios “investment grade.” Hence, you have the Baa bond yield! The Baa bond yield represents the “worst of the best” in the “investment grade” corporate bond market. Still investment grade but lower in quality than Aaa – rated bonds, which means higher yield.

The chart below shows us an index of what the yields/rates have been on Baa corporate bonds over time. At the time of this writing (6-27-2023), this index shows a yield of 5.70%. Needless to say, the rate chart below is much better than the 10-Year Treasury Bond that is currently yielding 3.77%. Again, the reason corporates are favored over treasuries.

Now that the insurance company knows that it can invest their money and earn around 5.70% on this money that is going into their “general account”, the carrier needs to allocate that money between the bonds and the call options. To keep the math simple, let’s just round up and say that the carrier can get 6% on the bonds they purchase today, which is very reasonable. The bonds will be purchased to guarantee that the money grows back to $100,000 every single year, regardless of what the S&P 500 does. So, the carrier needs to figure out how much to put into bonds so at the end of year 1, it grows back to the $100k that the client put in. THIS IS HOW THE CARRIER IS ABLE TO SUPPORT THE POLICY GUARANTEES. The call option chunk will give the Indexed Annuity the “link” to the stock market in the up years. Again, bonds equal guarantees and options = upside.

#3: The Carrier’s Cut

Before we calculate how much money goes to bonds and how much money goes to the call options, the carrier needs to take their cut… This is where the “carrier spread” comes in. That is, the carrier shaves a little off the top of that 6% annual bond income. That “spread” is how the carrier makes money as well as to cover the acquisition expenses; such as agent and distributor commission. Ever been asked by a client, “so if the market skyrockets, the carrier kept everything above the cap?”. The answer is no. Carrier’s generally make their money off this spread, period!!! How much spread does the carrier require? It depends…

Our carrier has shareholders that require them to make a certain amount of money on the carrier’s capital. And make no mistake that putting a case on the books costs a carrier “capital.” Afterall, the carrier has to pay for the administration, paperwork, and the big one, agent commission. This is why if you have ever seen a carrier grow “too fast,” they will shut off new sales.

There are various measurements on the amount of “money” the carrier makes off their “investment,” such as Return on Investment (ROI) and Internal Rate of Return (IRR).

To simplify this, let’s say that we – the carrier – pay $7,000 to put our $100,000 on the books, or 7% of the premium. This is simplified because we are just using the agent commission of 7% above as the upfront expenditures (Acquisition Costs). Technically, there would be a little more but again, lets keep the math simple. If the carrier shareholders demanded an 8% “Internal Rate of Return” over the 10-year life of our product, what annual income would be required for the carrier to achieve that? Said another way, what annual dollar amount would have to go into the carrier’s pocket in order to equal a 8% “internal rate of return” on the carrier’s $7,000 upfront expenditure? If you put this into your financial calculator, it would require $1,043 per year to the carrier (PV=-9,000, N=10, %=8, FV=0, solve for PMT). In other words, by the carrier “investing” $7,000 of their own money, in order to get an 8% return over the 10-year life of the product, that carrier would need 1.043% ($1,043) off the top of our 6%. Hence, a “spread” of around 1%. Again, let’s keep the math round. This spread of 1% will be taken off the “yield” every year so the carrier gets their roughly $1,000 cash flow that is required for them to hit their 8% IRR target. Note: In corporate finance you learn that if the IRR is greater than the carrier’s “cost of capital,” it is a project that is worthwhile. Hence, if a carrier borrows money at 5.70% (Cost of Capital) and gets an IRR on that money/capital at 8%, that is a product that has a positive “Net Present Value” and is good! By the way, me using a “cost of capital” example of 5.70% is on purpose!!! Remember, if the carrier was issuing bonds that are Baa rated for example, what yield would they have to offer their creditors? 5.70% per our chart above…

#4: Calculating the Call Option Budget

After the carrier takes it’s 1% off the top, we have 5% (6% – 1%) in pricing to play with as we invest the client’s $100,000. This is where we need to divide the money between the bonds and the call options. The bonds need to guarantee $100,000 at the end of every year to – again – support the policy guarantees. So, what dollar amount needs to go into the bonds – earning 5% – so that those bonds in the general account grow back to $100,000 at the end of the year? Hint: The correct answer is NOT $95,000!!! The correct answer is $95,238. Thus, if you add 5% to $95,238 you will get $100,000. So, if the insurance carrier is investing $95,238 in bonds, what are they doing with the other $4,762? Call options. We have arrived at our call option budget.

Review:

What have we done so far? So far, we have designed the commission level on the product at 7%, We also calculated how much the carrier needs in “spread” to make the shareholders happy, and we have also arrived at our call option budget of 4.76% ($4,762 options budget divided by $100,000) that will soon determine the cap. Note: ALL OF THESE CALCULATIONS REVOLVE AROUND THE INTEREST RATE OF 6%. THIS IS WHY INDEXED ANNUITY PRICING HAS GOTTEN BETTER OVER THE LAST COUPLE OF YEARs IF YOU LOOK AT THE AFFOREMENTTIONED RATE CHART. RATES HAVE RISEN WHICH GIVES CARRIERS MORE OF A CALL OPTION BUDGET!!!

#5: Buying and Selling Call Options to Arrive at Our “Cap”

So, we have $4,762 to buy call options that link our client’s $100,000 to the S&P500. Said another way, although we are buying call options for $4,762, the return that we will get ultimately will be on a “notional value” of $100,000. That is how call options works. That is a call option budget of 4.76% of our $100,000. So, the first thing we want to do is look at the prices of call options on the S&P 500 (SPX). We want this call option to give us ALL of the upside of the S&P 500 between now and 12 months from now, because our product is an “annual reset”. Note: My discussion below is going to be largely about percentages. The exact dollar amounts to link the client’s $100,000 would be just a function of buying multiples of what we are talking about below. The exact dollar amounts are not important. The call option budget PERCENTAGES is important.

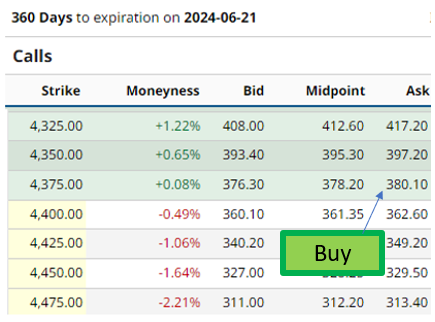

The chart above represents five rows – out of hundreds of rows – that represent today’s (6/27/23) option prices for an S&P 500 option that expires approximately one year from now. Because we want this option to give us growth on our client’s money from where the S&P 500 Index is today (4,378), we need to find the “strike price” that is close to that number. In other words, we want to buy an “at the money” call option. So, we need to see what options sellers are “asking” for these options. It appears that we can buy an option for $380.10 on a S&P 500 value of 4,375. THIS CALL OPTION REPRESENTS A WHOPPING 8.69% (380.10 divided by 4,375) of the “Notional Value” that is linked to the market!!! We have a problem here because our options budget is only 4.76%.

No fear, there is a solution here. That solution is, that we can buy this option but then immediately SELL another option that will give us back approximately 3.93%. This will ensure that our net options cost is only 4.76%. In other words, by us buying an option for 8.69% and selling one for 3.93%, our total NET cost will be our options budget of 4.76%. (8.69% – 3.93% = 4.76%).

So above, lets buy the “at the money” option for 8.69% of the “notional value.”

Selling a Call Option

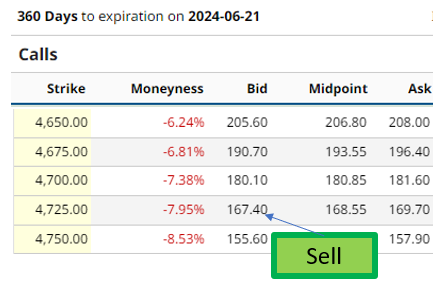

As you can see in the options pricing tables above or below, the higher the “strike price” on call options, the cheaper they are. It is because the “strike price” represents the point in time where the option purchaser actually starts making money. Hence, “in the money.” So, if we are selling a call option, we want to go as far down the “strike price” as we can. This is because when the market increases to that number, which is the point that we will be giving the upside to somebody else!!! Ideally, we would just purchase the option that we already did above and not have to sell a call option. However, we don’t have the large call option budget to do that, therefore we must sacrifice some upside. So, let’s go down the list and see what we need to sell. We need to produce about $171 (3.93% of 4,375) so that we net out to our 4.76% budget, OR CLOSE TO.

We found something close!!! We can sell an option for $167.40 at a strike price of 4,725. What does this mean?

- We netted out to a cost of $212.70 (Paid $380.10 – Sold $167.40). This represents something very close to our call option budget – 4.86% ($212.70 divided by 4,375). That is slightly higher than our 4.76% budget but close enough!!!

- We just created a product with an approximate “CAP” of 8%. This is because we are participating in the upside of the market starting at 4,375 (first chart) and handing off the upside “participation” in the market once it crosses over 4,725. 4,725 is 8% higher than 4,375.

What we have just done is created an indexed annuity that:

- Guarantees the client’s money will never be lost. This is because the carrier has the bonds that grow back the money to $100,000 every year, ASSUMING RATES STAY THE SAME.

- Gives the shareholders their “IRR” , ASSUMING RATES STAY THE SAME.

- Gives the carrier a 4.86% (close to 4.76%) call option budget to buy the call options after they expire every year, ASSUMING RATES STAY THE SAME.

- Gives the carrier a direct link to the S&P 500 up to a cap of 8% that they can pass through to the client.

- Pays the agent a 7% commission.

Although my calculations are my own calculations and not specific to a carrier, the product I just explained is actually quite conservative to what exists today. For instance, one of our most popular indexed annuities by a carrier that is a “household name” currently has an 11% cap. Again, NO FEES. How can they do that relative to my numbers above? Numerous ways. Maybe the carrier is demanding less “spread” for themselves. Or maybe the carrier is able to get investments at higher yields than my 6%. Both of these would mean more call option budget.

I am fully cognizant that this was a three-coffee article for you to read, but I promise you, if you are serious about indexed products, this article will help you in the future when it comes to answering questions about “how do the carriers do it?.”

For The Rest Of The Whitepaper.

Add yourself to our weekly email list and you will see why CG Financial Group is one of the fastest growing annuity, life, and LTC IMOs in the industry!

"How The Watch Is Built" Article will appear after you complete the form.

By giving us your information below, you are attesting that you are a financial professional and also consenting to receiving ongoing emails with similar content.

You have successfully accessed the material!

By Submitting this form, you are consenting to receive marketing emails from CG Financial Group. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe link, found at the bottom of every email. Emails are services by Constant Contact.