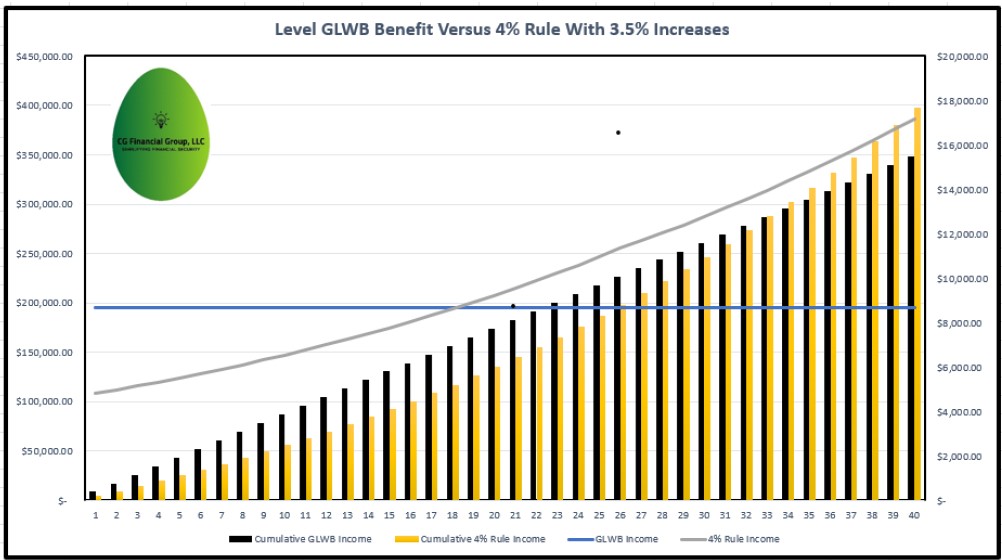

One of the biggest objections to annuities with a guaranteed withdrawal benefit rider is that they usually are just level payments and do not include adjustments for inflation.

Some of the anti-annuity folks will go on to discuss how the 4% rule using stocks and bonds actually does incorporate inflation adjustments. THIS IS CORRECT. However, because of the sheer size of the annuity payouts in today’s market, oftentimes the level annuity payments come out as being much more lucrative than the “4% rule” over one’s projected retirement. This is demonstrated by the chart below assuming a 3.5% inflation rate.

Scenario:

$100,000 in premium deferring for two years. The 4% rule versus the highest paying annuity today for this scenario.

4% Rule:

63 year old client. He/she defers two years and gets a cumulative (hypothetical) 20% return in the “market” between now and age 65. Then, he/she will take $4,800 out in the first year of retirement, abiding by the “4% rule”. In this example we will increase that number by 3.5% each year for inflation. That is the grey Line going up, represented by the right axis. Their cumulative income is the Orange Bar represented by the left axis.

Annuity:

They defer two years and are able to take a guaranteed level income of $8,700 per year, period. Blue line is annual income. The black bar is the cumulative income with the annuity.

How long does it take for the 4% to catch up from an income standpoint? Around the 18th year, where the lines cross. Most importantly, when does the CUMULATIVE INCOME catch up to the annuity? Somewhere around the 33rd year in retirement.

This doesn’t even account for the “time value of money” of having the larger annuity payments earlier.

0 Comments