If you had a choice between inheriting 40% of Jim’s estate or 100% of Richard’s estate, which one would you choose? My answer is:

It depends…

Of course, this is a ridiculously vague question that requires more information in order for you to make the correct choice. Who are these people? How much does each person have, Etc.? Choosing to inherit 100% of Jim’s estate with the minimal amount of information given above, just because 100% is larger than 40%, seems completely haphazard. Afterall, we know nothing about Jim and Richard!

Even though my example above may seem egregious, I do see these types of decisions being made every week when it comes to indexed products. My example above is equivalent to an agent or a client preferring an indexed product with a 100% participation rate over a product with a 40% participation rate, merely because 100% is larger than 40%.

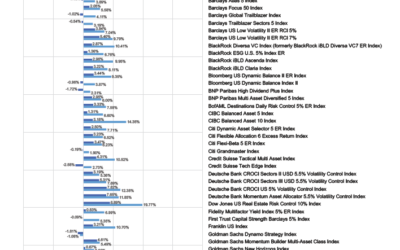

A while back I posted on LinkedIn examples of the interest credits that my clients were currently receiving on their annual statements. This was to educate financial professionals that these indexed products are doing as they were designed to do. That is, to beat the bank, not the stock market!!! Also, to provide security in an insecure world… That is when the anti-annuity trolls chimed in with accusations and also stating that “it made no sense that the clients could be receiving that much interest when the BNP Paribas volatility-controlled index was not reflecting the extensive growth that I was communicating.” They basically accused me of lying. That is when I indicated that the annuity actually had a 190% participation rate over that statement period, which means the client got almost double the return that the actual index did. At that point they effectively accused me of lying about the fact that the product had a 190% participation rate. They made statements like, “what indexed annuities don’t have caps?” and “it is impossible for the companies to give 190% participation rates on the market”, etc.

This LinkedIn exchange served as a great microcosm of the confusion that exists around caps, par rates, and volatility-controlled strategies. I will explain.

VERY Basic Indexed Annuity Pricing

Although this logic below would also apply to indexed universal life, I will use annuities as an example. When the carrier invests the clients’ money, whether a fixed annuity or a fixed indexed annuity, the “General Account” investments will give the carrier maybe 5%, for example, per year on that investment. Well, the notion with indexed annuities is that instead of the carrier giving the consumer a fixed rate of 4% (for example) what if that carrier took that 4% and instead bought call options each year with it? So, if a client paid $100,000 in premium, instead of getting $4,000 in interest that first year – as they would with a fixed rate annuity – what if that carrier bought call options with that $4,000 that are linked to a stock market index? What I just explained is the difference between a “Multi Year Guaranteed Annuity” and a “Fixed Indexed Annuity. Also, in my example above, notice how the carrier made money? The carrier got 5% in interest from their General Account but passed through 4% to the client. The 1% difference is the “carrier spread”.

With a Fixed Indexed Annuity, by the carrier taking that $4,000 and buying call options on a stock market index, the carrier is linking the client’s growth to that particular index – which will likely give the client much more upside POTENTIAL than the $4,000 that the client could have otherwise received in a Multi-Year Guaranteed Annuity.

When the carrier goes to the investment bank to buy call options on the Index, the carrier only has a set amount of money, $4,000 in my example. That $4,000 is the call option budget that the carrier has to link the client’s $100,000 (notional value) to the index that the client’s product is based on. So, to greatly simplify, it is at that point where the investment bank EFFECTIVELY agrees to give the carrier a certain percentage of that index’s growth. For example, our client may get 40% of the growth in the S&P 500 index over the next year. That 40% is not 100% because the carrier only had $4,000, which only bought a 40% “PARTICIPATION RATE”. The logic above can also apply to indexed annuities with caps. The only difference is that the insurance company might give the client an 8% “cap” instead of a 40% participation rate. Again, I am using random numbers here. In either case, the par rates and caps are a way for the investment bank to limit the amount of money they have to pay out, in exchange for the $4,000 option premium.

What if the index/market drops over a year’s time? The call options expire worthless for that particular year. The client gets no growth, but their $100,000 premium is still intact!!! That is when the carrier goes back to the investment bank the following year with another $4,000 (assuming the same interest rates) to buy additional call options. Year after year this process continues. Note: The carriers do not call the investment banks on every case, like my simplified $100,000 example. They do it in multi-million dollar “tranches.” Also, carriers usually buy AND SELL options versus my simplified examples above.

The most important part above is that the “limiters” such as participation rates and caps are on the products because the investment banks can only offer so much upside potential on a particular index. Afterall, the investment bank is only getting $4,000 in my example.

Uncapped Is NOT Unlimited

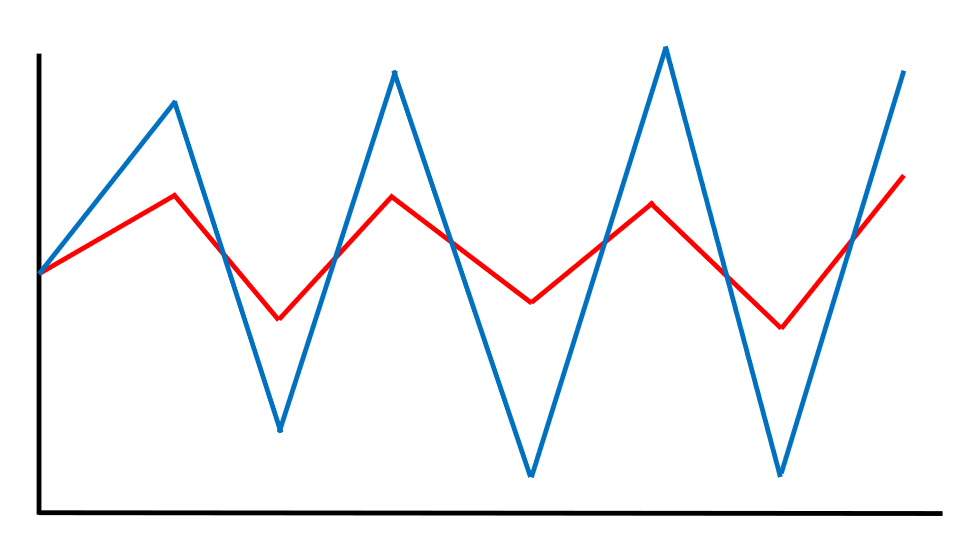

Let’s start with the client’s point of view and a mutual fund analogy. If your clients had a choice between the two mutual funds below to invest their money in, which would they prefer? The volatile blue mutual fund, or the more stable red mutual fund? Most agents would tell me that their clients would likely choose the red, because it is more stable!!! These agents are usually agents that work with more conservative and retirement-age clients.

Volatility Comparison

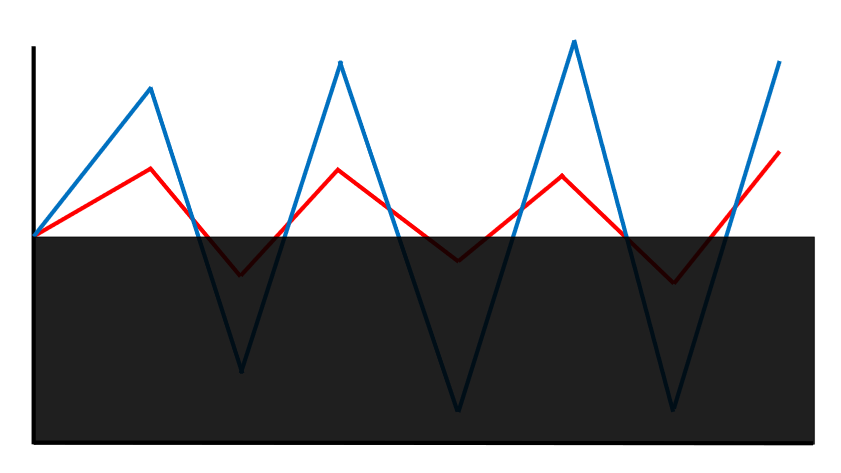

Then I will throw a curveball to the agent and say, what if I had some magical way to get rid of all of the down years on these two mutual funds? Now which option would most of your clients choose below after I black out the down years? The agents invariably come back and say, “I want to change my answer to the BLUE mutual fund”!!!

The reason they choose the blue is because there is no risk of the client losing their money, so why not go with the option that has the most upside potential?

What I just explained in my mutual fund analogy was the difference between a Non-Volatility-Controlled Index , like the S&P 500, and a volatility-controlled index that have proliferated over the last decade.

The S&P 500 index is quite simply five hundred stocks, and as such can give significant upside potential and downside risk. However, when the index is in the wrapper of an indexed annuity, the downside disappears. Conversely, volatility-controlled strategies do have “some” equities included in the index but there are also components to limit the upside and the downside. Those components are: cash, bonds, commodities, etc. The allocation of equities versus cash (etc.) in a volatility-controlled index depends on the index chosen. Furthermore, even within one particular volatility-controlled index, the allocation ebbs and flows with how volatile the underlying equities are. As equities get more volatile, the allocation to equities decreases, vice versa. The main mission of these volatility-controlled indexes is to target a certain level of volatility/standard deviation.

So, if most clients would choose the blue line in my mutual fund example, then is my point that the S&P 500 strategy is the better choice within indexed annuities? Not even close. This is because we have “limiters” like caps, par rates, and spreads in the indexed annuities that are harsher with the S&P 500 than the volatility-controlled indices. Why is this?

What is high potential gain for the client is high potential loss for the investment bank. The high volatility in the S&P 500 can subject the investment bank to significant risk for only $4,000 in call option premium. This is because the peaks are high on the blue. THIS IS EXACTLY WHY VOLATILITY IMPACTS THE COST OF CALL OPTIONS. The more volatile the respective index is, the more expensive the investment bank will make the options – all else equal. So, for the clients with indexed annuities that have a choice between the straight S&P 500 index or a volatility-controlled index, they will find that the S&P 500 index strategy will generally have more “limiters” of some sort: like caps, participation rates, spreads. Our client may also see that the “red” volatility-controlled index strategy does not have a “cap.” It may also have a 200% participation rate, for example.

Which is better? 40% of the blue line or 200% of the red line? Or, the blue line with an 8% cap or the red line that is “uncapped”? This circles us back to my analogy, which is better, 40% of Jim’s estate or 100% of Richard’s estate? The answer is:

It depends…

0 Comments