With the tax increases that will almost inevitably happen, the entire world is talking about Roth IRA‘s. So, I thought it would be good to give some basic and not-so basic information on Roth IRA‘s, Roth Conversions, order of withdrawals, etc. Before I go there, allow me to break with professional etiquette and vent a little.

What I would like to vent about is, financial professionals using the environment we are in to convince their clients to convert their IRAs and 401ks to Roth IRAs without a systematic plan. I ran into a nice gentleman who was concerned about his looming tax bill because his advisor recommended he convert all of his $300,000 IRA AT ONCE. What that means is, 1. He will have a six-figure tax bill that is due by today, April 18th!!! And… 2. With the additional $300k added to his other income, he will be pushed into the highest tax bracket. Converting while you are in a higher tax bracket than you will be at in retirement defeats the purpose of converting!!! But I guess for some, by using increasing taxes as a fear tactic along with “but I can help” is a way to gain clients. Please, please, please, make sure you use an advisor that will help you with a systematic conversion strategy if you do choose to convert. But I digress…

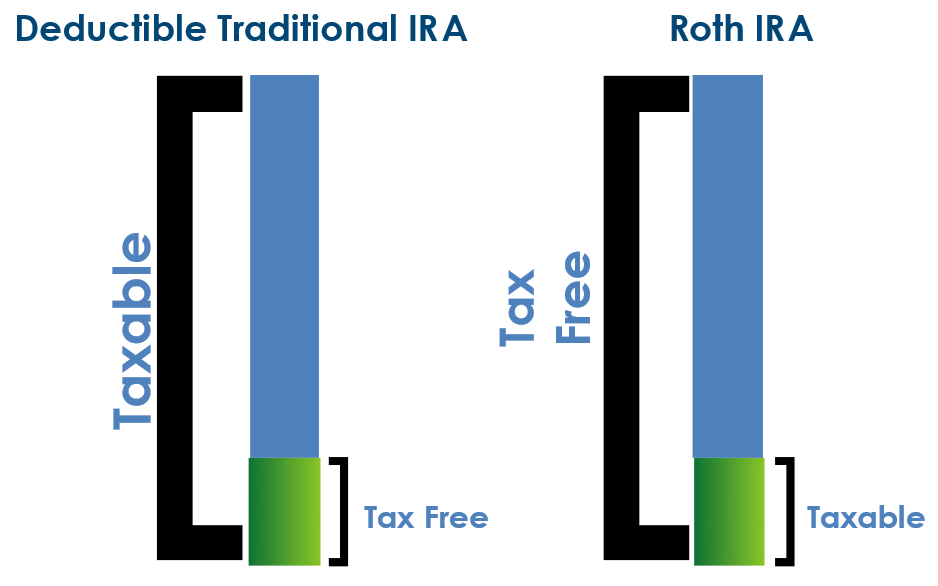

Let’s start out basic and discuss the differences between a traditional IRA and a Roth IRA. Below is a diagram I usually draw out for my clients as I explain the Traditional IRA versus Roth IRA concept.

Explaining Roths Versus Traditional IRAs

What I say is on the right-hand side is you are paying taxes on the “seed” and on the left-hand side you are paying taxes on the “harvest.” In other words, with one, you are putting in after-tax dollars in order to be tax-free at retirement. With the other, you get the deduction, but those chickens come home to roost in retirement.

Now, the seed versus the harvest is a nice catchy line I know, but without getting into the math on which one is better, the decision really comes down to your expectations of YOUR SPECIFIC tax rates at retirement versus today. As much debate as there is around which one to go with, it is really as simple as this: If you believe your tax rates will be higher in retirement than today, go with the Roth. And vice versa. This is why I said at the outset that if you are converting while at a high tax rate today, that defeats the purpose, unless you expect your retirement tax bracket to be EVEN HIGHER.

Now, there is more to the IRA versus Roth tradeoffs than the simplified diagram above. For example, withdrawals from the Roth IRA‘s do not add to your “provisional income“, which determines if your Social Security is taxable. This is a good thing for Roths!!! We don’t want taxes on Social Security.

So, what is the core benefit of the Roth IRA? AGAIN, NO TAXES AT RETIREMENT. In general, if you have had ANY Roth IRA established – not just the one you are withdrawing from – for at least five years and are age 59 1/2 or older, you can take out what you put in plus the growth without paying any taxes at all. And without having that dollar amount added to your “provisional income” for social security taxation purposes. Pretty simple huh?

But life isn’t always that simple. So, let’s get into the nitty gritty.

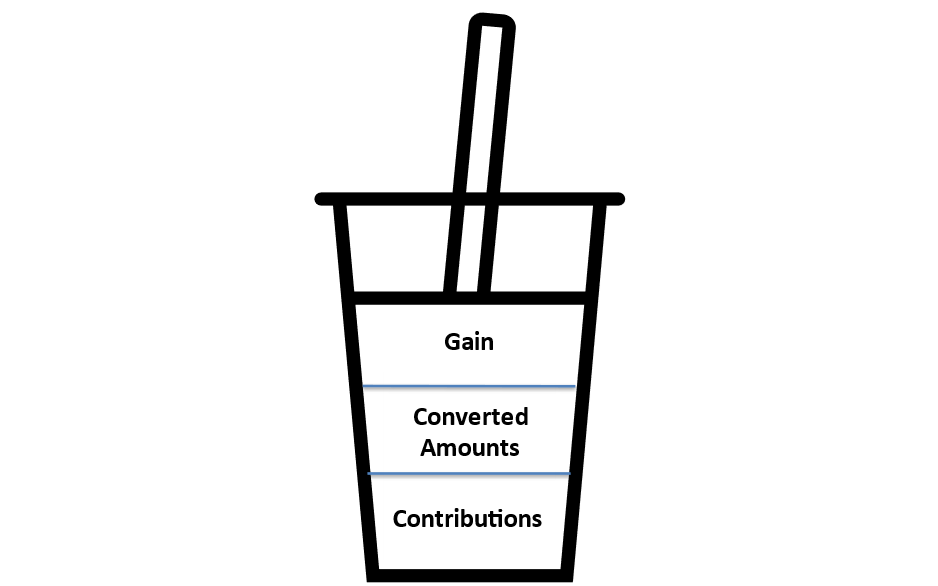

Order of Withdrawals

The “order of withdrawals” is important because the different classes of money (your contributions, converted amounts, gain) you are withdrawing can be treated differently from a tax standpoint. The below cup represents the order of withdrawal‘s from a Roth IRA. It is a lot like drinking with a straw. Depending on the density of the fluids, many times what you pour into the cup first stays on the bottom, then the next fluid is layered on top of it and then the next fluid is on the very top. Ever pour a stiff drink where you put the alcohol in first and you forget to stir it? The first thing up the straw is 100% alcohol! That is my analogy for a “first in first out“ treatment. This is the treatment that Roth IRAs enjoy. When you take withdrawals out of the Roth IRA, your contributions come out first, then any amounts you had previously converted to the Roth from a Traditional IRA, then the gain.

Withdrawing Contributions

The tax treatment of contributions is what makes “FIFO” so appealing. If “Joe” is 35 years old today and put in $6,000 and had something come up next year where he needed $4,000, could he take it without any penalty? Absolutely. As the years go by and his “contributions” pile up in the Roth, he has that dollar amount that he can access at any time without a 10% penalty OR TAX. The lack of tax should be common sense because what he put in was after-tax.

Withdrawing Converted Amounts

Now let’s take our 35-year-old “Joe” again and make this a little more complicated. Let’s say that Joe put in his $6,000 contribution today, and one year from now he moved in $10,000 that he converted from a Traditional IRA. Now let’s say that a year later he wanted to access $8,000. How is that treated? Note: Keep in mind he already paid taxes through the conversion. Therefore, this process is to determine whether he gets a 10% penalty or not. He cannot be taxed twice!

His first $6,000 that was his contribution is free and clear of any taxes or penalties (again, even though he is now only 37 years old!). However, the other $2,000 that he accesses is from the conversion he did the year prior. What is the tax/penalty treatment on that money? He is not taxed on the $2,000 withdrawal because – again – he just paid taxes on the conversion the year prior. However, he is penalized 10% because he did not satisfy the Roth IRA 5-year holding period requirement. Note: Some folks believe that if he set up a separate Roth IRA many years ago that the clock started ticking on this conversion back then and therefore he would not get a 10% penalty on the conversion, at least if the first Roth was set up more than 5-years ago. That is false when it comes to CONVERSIONS. Otherwise, you would be able to convert Pre-tax money to a Roth then immediately withdraw that conversion amount and thus avoid the 10% penalty. The IRS is ahead of us on this one. There are separate 5-year holding period requirements for conversions.

With the converted amount, can you fail the 5-year holding period requirement and NOT have to pay the 10% penalty? Yes, there are nine “Special Purposes” the IRS allows you to have to avoid the 10% penalty:

- You are older than 59 ½

- Death

- Disability

- First Home Purchase (Max $10,000)

- Medical Expenses

- Medical Insurance Premiums while unemployed

- 72Ts or Annuitization

- College Expenses

- Birth/Adoption

For example, if Joe was fifty-nine when he converted to the Roth, he can take his Conversion amount out six months later (59 ½) without receiving a 10% penalty. TO KEEP IT SIMPLE, IN ANY OF THESE SCENARIOS IN THIS ARTICLE, IF JOE TAKES MONEY (EVEN GAIN) FOR ANY OF THE 9 REASONS ABOVE, THERE WILL NOT BE A 10% PENALTY. It is just a matter of if you are taxed or not.

Naturally, if Joe satisfied the 5-year holding period rule and also experienced one of the 9 items above, there is NO TAXES and NO PENALTY.

Withdrawing Gain Amounts

Now let’s talk about the treatment of the gains. Whether it is gain from the contributions or gain from the conversion amount, it is at the top of our glass and the last thing to be sucked out by our straw. So now let’s assume that Joe did this.

- At age 35: Contributed $6,000

- At age 36: Put in $10,000 that was converted from a Traditional IRA

- At age 39: He wanted to access $20,000 to buy a car (Note: The Roth grew to $25,000 at this point)

In this example, Joe is taking out all three areas of our fluid in our glass. The treatment of the first two areas (contributions, conversion amount), you should know by now. No taxes on either of the two amounts but a 10% penalty on the conversion amount – because he failed the “5-year rule” on the conversion amount. Plus, he did not meet any of the nine Special Purposes.

For the withdrawal of GAIN, he receives a 10% penalty and is taxed on the gain. This is because he failed the 5-year test, and he did not satisfy any of the nine “Special Purposes”.

Withdrawing Gain Amounts: Alternative Scenario

Now let’s alter the scenario a little bit and assume that he had taken the withdrawal for any of the reasons you see in our list of nine “Special Purposes”, instead of just to buy a car. In this case, the gain would be taxed (because he did not satisfy the 5-year requirement) but there would NOT be a 10% penalty. Remember, no 10% penalty applies if he takes the money for any of the nine reasons.

Withdrawing Gain Amounts: Another Alternative Scenario

Now let’s say that Joe many years down the road does indeed meet the 5- year holding requirement. He has held the Roth for at least 5-years after his original contribution and ALSO 5-years after his conversion. Does he avoid the 10% penalty and taxation on the GAIN? It depends!

If the reason is for any of the first four (59 ½, death, disability, first home) of our “Special Purposes”, he pays no tax and no penalty. For example, he is over age 59 ½. This is how most Roth IRAs are intended.

If the withdrawal of gain is because of the last five (medical expenses, medical premiums, 72ts/annuitization, college, birth/adoption) – and thus he is not 59 ½ – then he pays taxes on the gain but no 10% penalty is due.

If the withdrawal had nothing to do with any of the nine “Special Purposes,” he pays taxes on the gain and a 10% penalty, even though he satisfied the 5-year holding period.

If you have any questions on the above content, feel free to call us at 515-986-3065.

0 Comments