This post is a bit of a brain-dump as I go down the list of products that sit in my head and why those products would be chosen. Think of clients that you might have that can use a solution that I point out below. Then call us for an illustration!!! I’m sure you can think of at least one!!!

I will soon be posting the same list for life insurance and LTC.

Annuities:

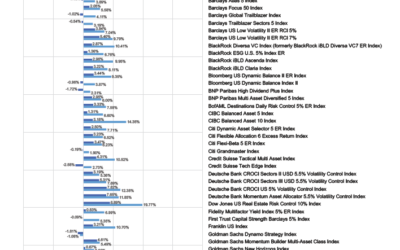

Indexed Annuities for Guaranteed Income: American Equity, Athene, AIG, and Nassau Re are among the highest paying GLWBs in the industry right now. American Equity is almost always #1, but their accumulation potential is horrible.

Best “Well Rounded” Annuity for Guaranteed Income: AIG’s Power 10 Protector Plus Income is very well rounded because it has income that is among the highest, while at the same time has an S&P 500 cap of 11% for premiums over $100k.

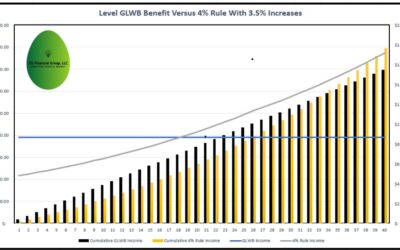

Best “Performance Based” GLWB: The GLWB that I like the best for income that is based off performance (in contrast to 100% guaranteed income) is the Agility product line by Athene. Allianz 222 and ABC is on the list as well.

Best Accumulation Focused Indexed Annuity: AIG! They currently have an 11% cap on their S&P 500 strategy, if the client has over $100k. Athene Performance Elite product also has great volatility controlled strategies. Furthermore, there is much more to the story than just current caps, par rates, etc. For instance, what is the company’s renewal rate integrity?

Annuities with unique withdrawal provisions: Athene’s Agility FIA has a 10% of PREMIUM withdrawal provision. This means that you can fund a life insurance policy with 1/10th of the premium you put into the annuity, and make the life policy a “10-pay”. Allianz has similar privileges.

Best Death Benefit Focused Indexed Annuity: National Western and Nassau Re each have products that allow for 10% “rollup rates” on the death benefit that the beneficiary will eventually get. Furthermore, the Athene Agility has the ability to turn the GLWB’s “Benefit Base” into the death benefit, if the beneficiary takes it out over 5- years.

Best Premium Bonus Indexed Annuity: I really like American Equity’s Asset Shield Bonus that has a 10% premium bonus and also very high caps. Great commission too.

Companies that allow for ongoing/flexible premiums: American Equity and Equitrust!!!

Companies with low minimum premiums so you can start an IRA or Roth IRA: American Equity and National Life.

Best company for Decedent IRAs going into an indexed annuity: Equitrust!!! They are very “decedent IRA friendly” and have great products to use. The MarketValue is my favorite for decedent IRA situations.

Highest MYGA Rates: Oceanview, Clear Spring Life, Sentinel, and Atlantic Coast Life tend to consistently have the highest MYGA rates!

Easiest MYGA companies to do business with: By far, GBU is the easiest to do business with!!! They are a great A rated fraternal that does things smoothly and differently!!!

MYGAs with good liquidity: GBU, American National, and Global Atlantic have 10% penalty free withdrawals starting in year 1!!!

MYGAs for Decedent IRAs: Equitrust and GBU will take almost any “decedent” situation. NQ Stretch, IRA with death after 2020, IRA with death prior to 2020, etc.

SPIAs with best payouts: Usually Equitrust and American National are toward the top! It depends on the scenario, in which case we would run you a “Cannex” report to show you the top products.

0 Comments